Get Involved

The Arizona Mortgage Lenders Association was developed for its members, by its members and we need your help! … [Click Here To Learn More...]

Capital Commentary

By Kirk Willison ● Jan 22, 2026

🎆 Happy New Year from Capital Commentary! As we step into 2026, a mid-term election year, we already see an increased focus on housing affordability from an administration hoping to maintain a GOP majority in Congress.

🚥Signaling change: The Trump administration is promising massive reforms to address housing affordability. The president already announced his intention to ban institutional investors from buying homes and spent a portion of his speech at the World Economic Forum in Davos on housing affordability. I expect it won’t be the last venue he will use to talk on the topic.

🔍 What’s in store?: In this 2026 inaugural issue of Capital Commentary takes a deep dive into possible solutions to make housing more affordable. We explore what these changes mean for current and future homeowners.

Let’s dive in!

1-Big thing: Housing is broken

We can all agree that housing in America is broken.

-

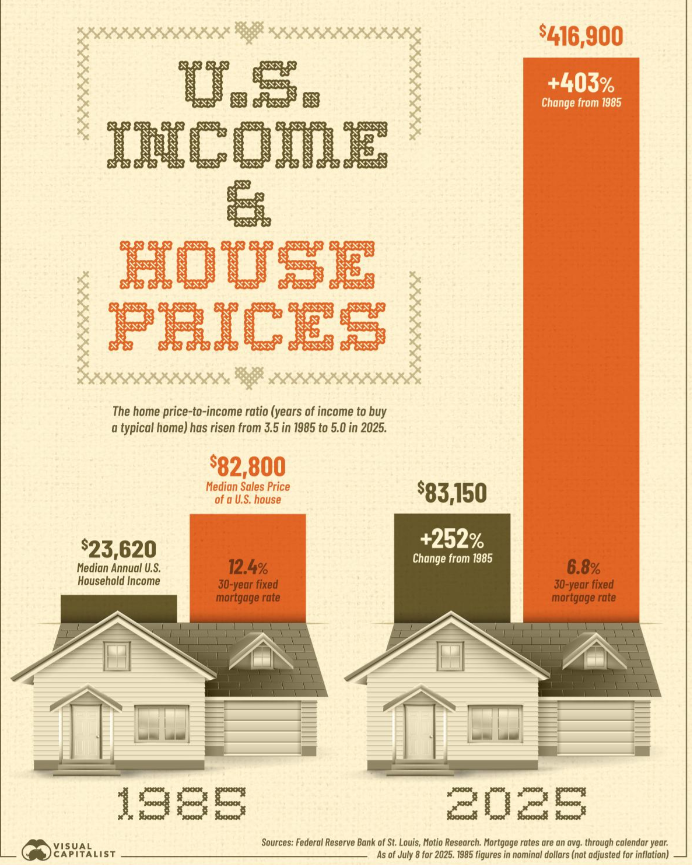

Homeownership is increasingly out of reach as the gap between average earnings and the income needed to purchase a home widens. As the graphic below illustrates, while incomes have risen 252% since 1985, home prices have soared 403% over the past 40 years.

Why it matters: The American dream turning into a nightmare for so many has real-world implications. Simply put, the frustration of being permanent renters leads many people to give up, conclude researchers Seung Hyeong Lee and Younggeun Yoo in a recent report featured in The Washington Post.

“When housing becomes unattainable, people do not simply stay renters — they often change how they live, work, and plan for the future.” – “‘Giving Up’: The Impact of Decreasing Housing Affordability on Consumption, Work Effort, and Investment”

On the other hand: They say the disparity suggests that renters who think they will be able to afford a home … are more motivated at work and committed to saving than those who have given up on the idea.

The big picture: Credit the Trump administration for its recognition of the housing crisis and its commitment to gather views from an array of interests – in Treasury and FHFA roundtables, in industry meetings and from constituents — on how to address it.

-

As interest rates hover around 6%, unemployment ticks up, and tariffs on building materials such as lumber, copper and cabinetry push the construction costs of homes ever higher, the time is right for significant corrective action.